West Virginia Electric Utility Regulation

States have taken a variety of approaches to address growing concerns of electrical costs, including deregulation. There is growing interest in West Virginia to deregulate the electric market for commercial and industrial consumers. This Science and Technology Note explores electric utility regulation in West Virginia and other states and explores the differences between a regulated and deregulated market.

Research Highlights

32 states, including West Virginia, regulate electric utilities through state Public Services Commissions.

Interest is growing to deregulate electric utilities for large West Virginia commercial and industrial users, primarily to help reduce costs and also increase innovation.

To help lower electric costs, West Virginia could seek to impose minimum electricity payments on large electricity users, similarly to Ohio.

Where Does Electricity Come From?

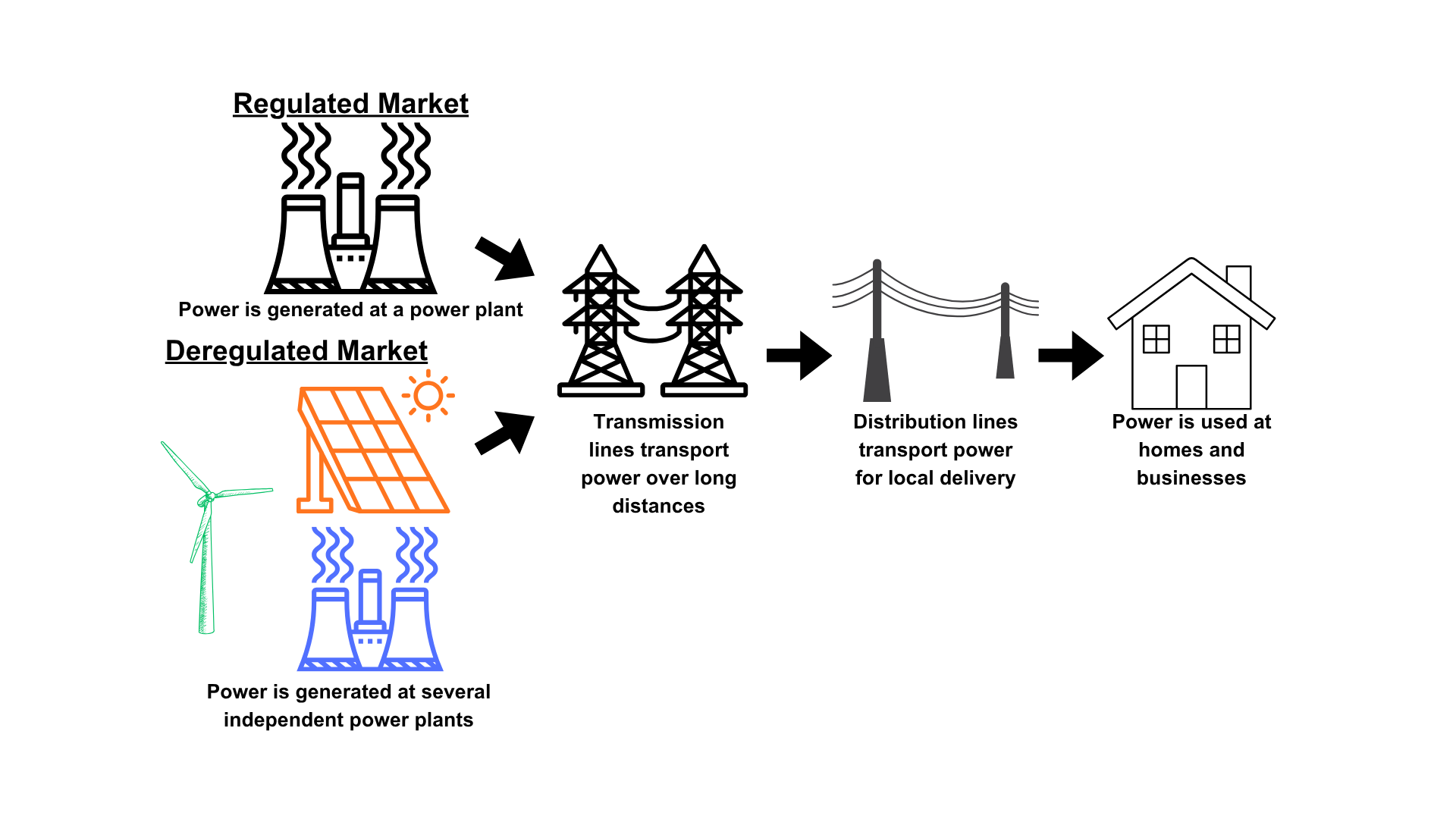

Electricity is generated in a variety of ways including: solar, wind, hydroelectricity, geothermal, coal, and gas. Coal is the most prevalent energy source in West Virginia, accounting for about 86% of all energy production. To reach the end-user after power generation, the voltage is increased at a transformer for efficient long distance transportation on a transmission line. Next, the voltage is brought back down at another transformer and finally delivered to a home or business locally via distribution lines.

Regulated vs. Deregulated Markets

State electric utility regulation and oversight has become a widely discussed topic. Due to the need for electricity access in the 20th century, electricity suppliers formed natural monopolies in the states or regions in which they operated due to high infrastructure costs and inefficiencies associated with another company reproducing the infrastructure in order to compete. To ensure fair customer treatment, states formed regulatory bodies to regulate electric utilities. In West Virginia, similarly to other states, the Public Services Commission (PSC) is the regulatory body. The PSC is charged with regulating rates that the electric utility is able to charge customers and must approve any rate increases the providers propose. In this system, the utility company owns or controls all of the infrastructure to generate, transport, and deliver power. A deregulated system enables electricity generation market competition, meaning there are multiple power generation companies from which an electric utility can purchase electricity and deliver to the customer. Generation companies may incentivize customers with lower costs or by using renewable energy sources. The customer informs the utility company which power generation company they want their electricity to come from. The utility then buys the power from the specified company to deliver to the customer.

Schematic showing the flow of electricity between generation and distribution in a regulated and deregulated market.

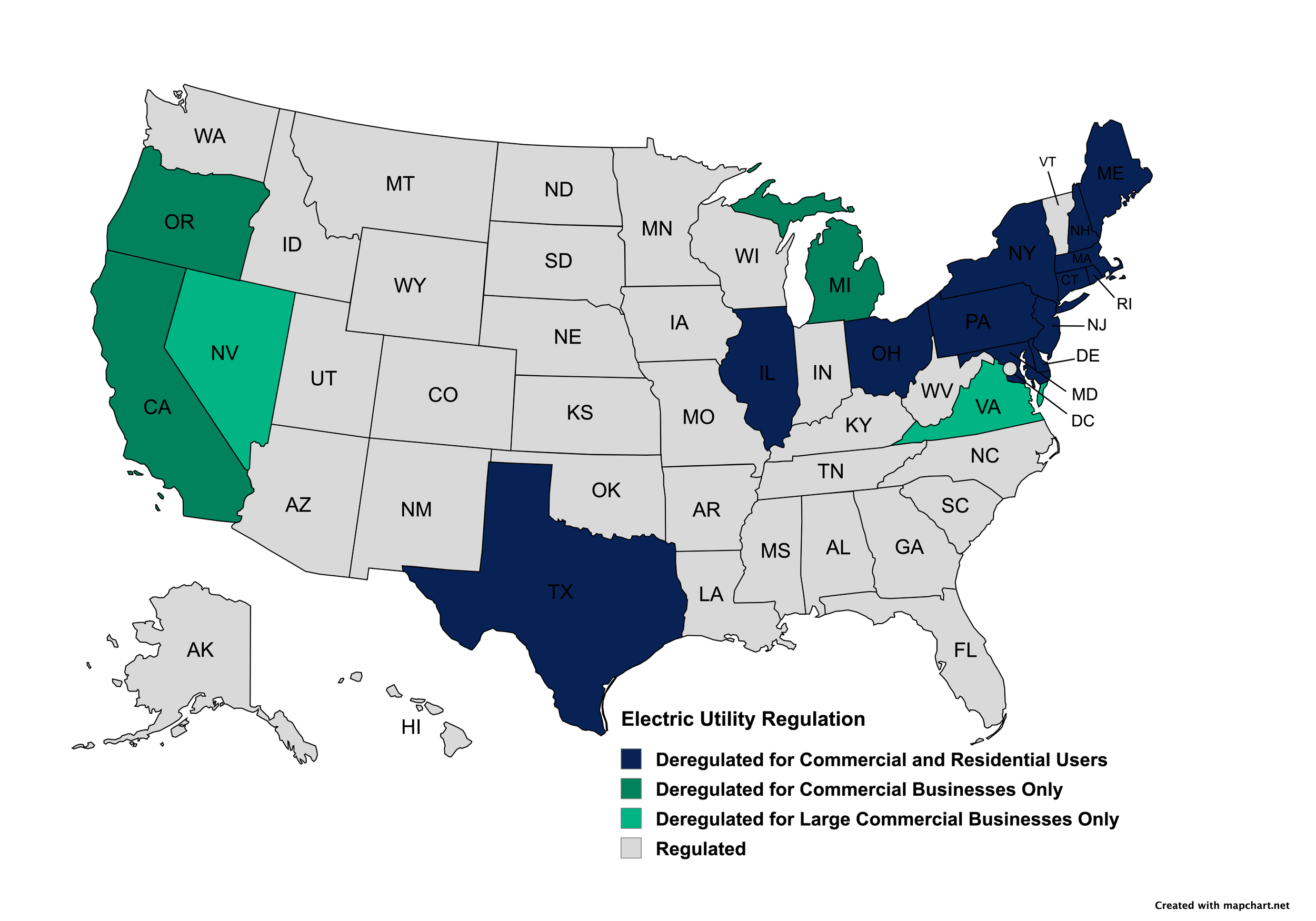

Regulation varies among states across the country. Most (32) states continue to regulate their electric utility through their state PSC. Thirteen states have fully deregulated electric utilities. Furthermore, some states have a partially deregulated utility. California, Oregon, and Michigan’s electric utilities are regulated for residential users and deregulated for commercial users, and some states may further differentiate based on commercial operation size. This strategy is thought to help promote market competition while protecting residential users from possible market fluctuations.

Map showing different electric utility regulations among states. Based on data from Electric Choice.

West Virginia Electric Utility Deregulation

There is growing interest in deregulating the electric utility market for commercial and industrial customers in West Virginia. Advocates for deregulating electric utilities in West Virginia cite the electricity price increase, arguing that rates are increasing more quickly than in other states like Ohio (1). They argue that deregulation leads to market competition among power generation companies, which should result in lower electricity prices. Deregulation proponents also reason that lowering electricity prices will be enticing for businesses seeking to expand in the state, including data centers.

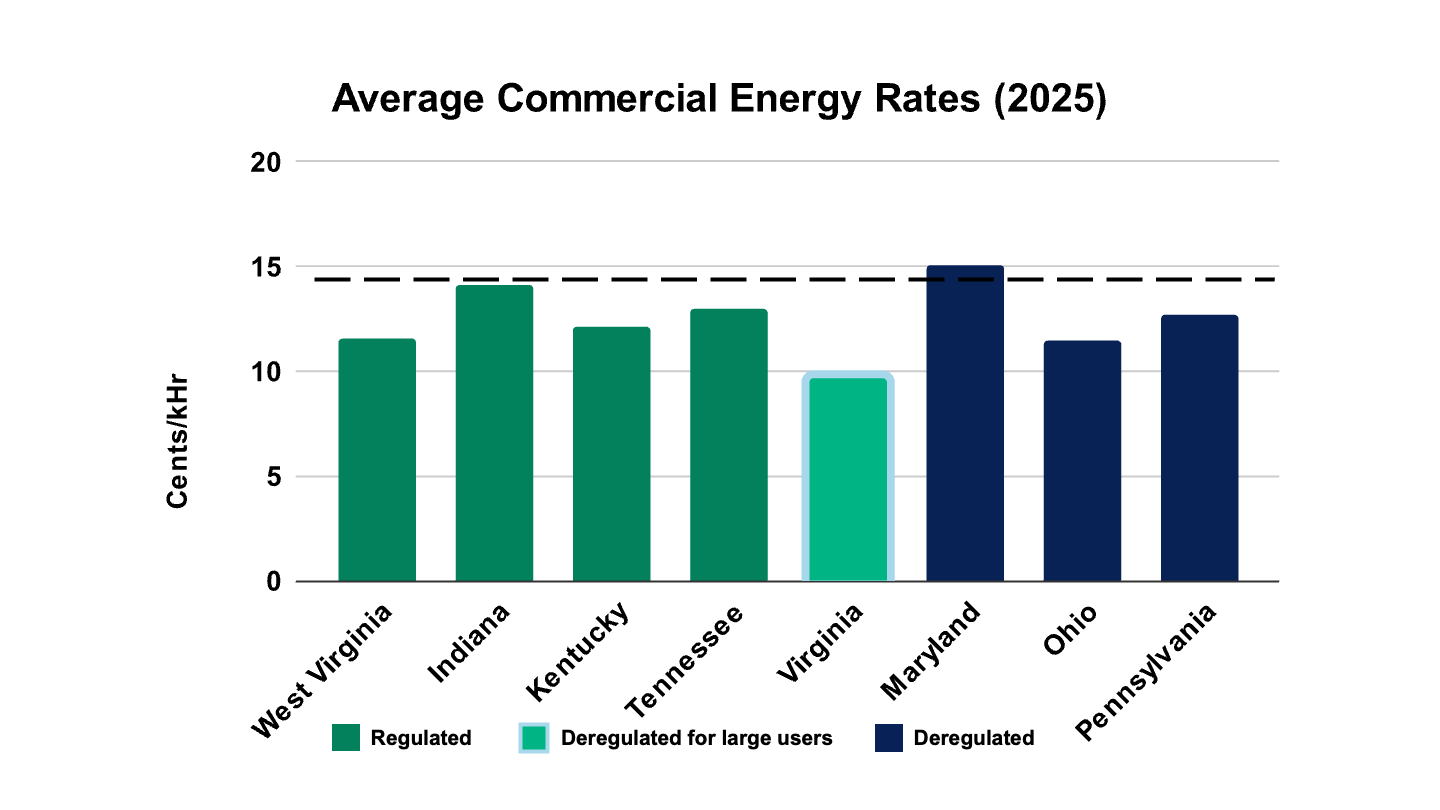

Deregulation critics argue that deregulation does not necessarily lower costs for customers. They cite a Harvard University study analyzing electricity rates from 1994-2016 that found that while deregulation led to lower power generation costs, electric rates for customers increased due to an increase in markups. Skeptics also argue that West Virginia currently has one of the lowest electricity rates in the region and attribute rate increases to the costs of using coal as a power generation source. Appalachian Power, West Virginia’s largest electric utility, has also cited contracts requiring them to buy coal at high prices as a reason for high rates.

Based on data from Electric Choice. The dashed line represents the average energy rate in the United States.

Deregulation advocates also argue that this system will increase power generation innovation and stimulate renewable energy sources, including solar and wind energy. Power generation companies would first need to consider West Virginia’s geography before expanding renewable energy assets. Solar energy currently generates less than 0.1% of all energy in the state and would likely be difficult to expand upon due to the mountainous geography. Renewable energy innovations could seek to expand upon the state’s wind farms, which are primarily located in Randolph, Grant, Tucker, and Greenbrier Counties and make up about 4% of West Virginia energy. Companies seeking to expand renewable energy output should also consider Governor Morrisey’s 50 by 50 plan, which seeks to increase the state’s energy output. This plan primarily focuses on coal, natural gas, and nuclear energy and may impact a company’s ability or incentives to construct additional wind or solar assets.

Opportunities to Lower Electric Costs

The primary goal for advocates of both regulated and deregulated markets is lower electric rates for customers. Data centers are large energy users and West Virginia is seeking to attract companies to build them in the state; however, this may increase electric costs for other users. One option could be to require large energy users to pay a minimum rate to electricity generators. This is similar to regulations in both Ohio, a state with deregulated utilities, and Indiana, a state with regulated electric utilities, which require data centers to pay for a minimum amount of the energy they are subscribed to. For example, if a company informs an electric utility that they will require 50 MW of energy each month but only end up using 10 MW, they will still be required to pay for more to help offset the cost to build the needed infrastructure. West Virginia could seek to implement similar regulations; though, it may disincentivize certain data center companies from building here.

1) November 3, 2025 presentation by Arnie Quinn of Vistra Corp to the Joint Committee on Energy and Public Works, Pipestem, WV

This Science and Technology Note was prepared by Nathan G. Burns, PhD, West Virginia Science & Technology Policy Fellow on behalf of the West Virginia Science and Technology Policy (WV STeP) Initiative. The WV STeP Initiative provides nonpartisan research and information to members of the West Virginia Legislature. This Note is intended for informational purposes only and does not indicate support or opposition to a particular bill or policy approach. Please contact info@wvstep.org for more information.